Key Customer Questions on Upgrading from QuickBooks to NetSuite

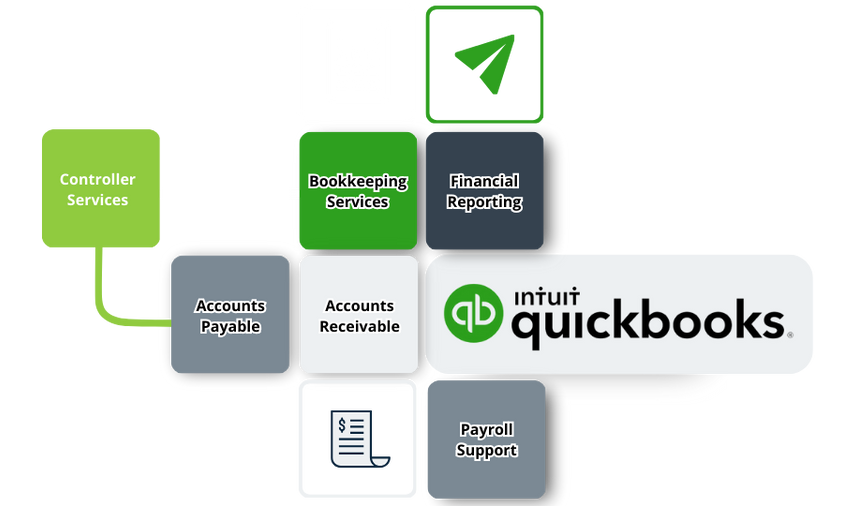

QuickBooks and NetSuite accounting software cater best to different businesses. Consider the following when upgrading to NetSuite from QuickBooks.

<!-- AddThis Advanced Settings generic via filter