What Does A Financial Controller Do and Why Do You Need One?

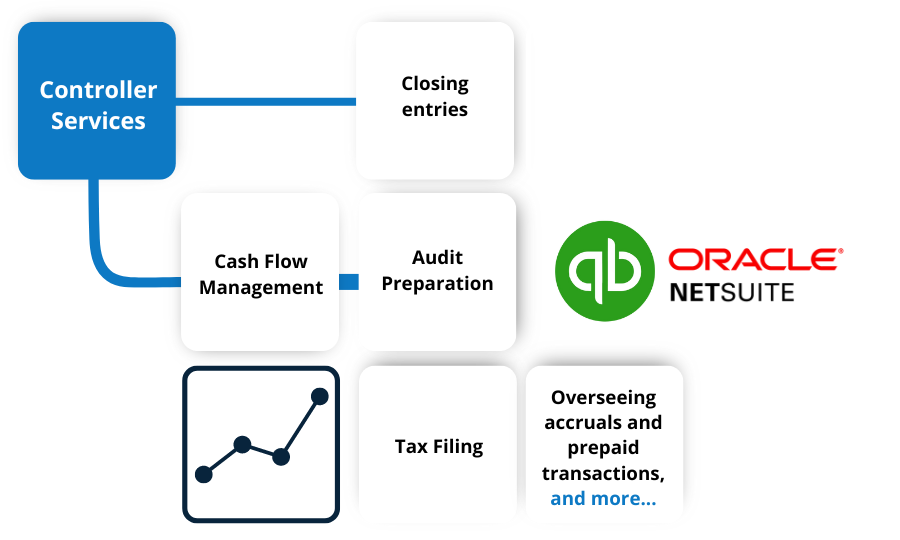

If you’re wondering, “What does a financial controller do, and how can they assist your business?,” it’s worth examining their role and responsibilities. Understanding more about their duties and how they can help your company should make it easier to know if you need their assistance.