We provide expert advice, personalized services and innovative tax solutions for your business.

Whether it’s a quick consultation or a longer-term project, we can assist you with:

- Identifying your tax strategy and alternative investment strategies

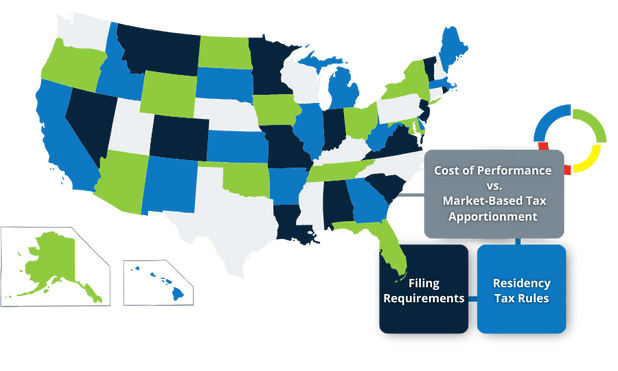

- Tax filing and compliance (including international and multi-state filing)

- Residency taxes

- IRS audit management and representation

- Calculating state tax apportionment