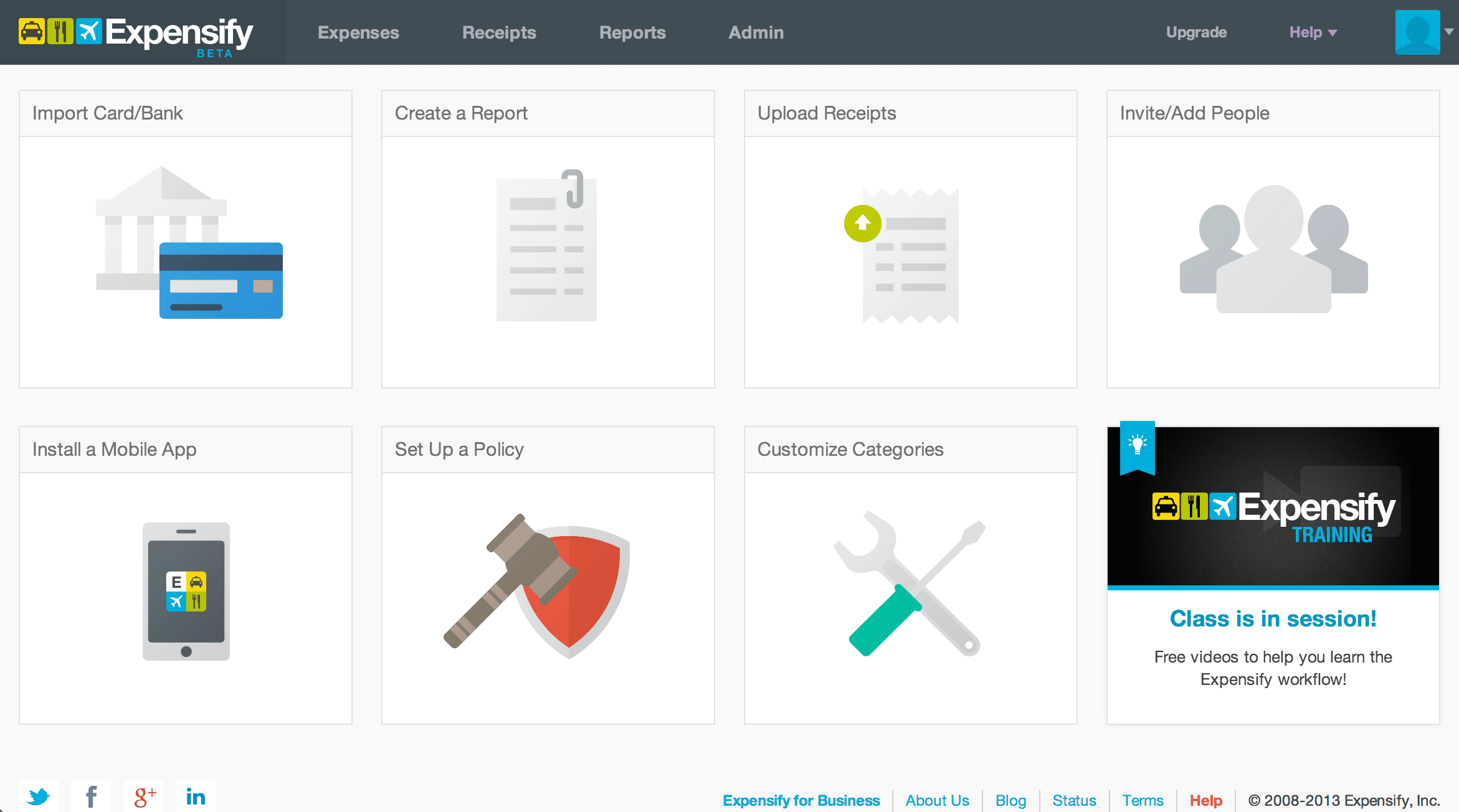

How Expensify Works

Businesses use Expensify to allow them to track employees’ business expenses easily through an app. This is especially useful for employees who often need to track their corporate spending. Even foreign receipts can be recorded and the data saved in the app. Expensify saves businesses time because they don’t have to manually enter or reconcile their expenses.

Expensify’s Features

Among many features, Expensify offers the benefit of automated:

- Travel and other business expense integration

- Real-time expense reporting

- Corporate account reconciliation

- Duplicate expense detection

- Tax tracking

- PCI compliance

- Credit card expense and reconciliation

SmartScan for Recording Your Receipts

One of the best features that Expensify brings to the table is SmartScan. Through optical character recognition (OCR) technology, your smartphone is a scanner to upload an image of your receipt. The software then evaluates the information on the receipt to extract and separate details about the transaction to ensure that it’s properly recorded and reported. For example, a sales associate might be using a corporate credit card to pay for expenses while on the road. By using SmartScan, details of any on-the-road expenses are recorded and exported to the corresponding account, along with any reimbursement requests and other information. This even works when business is being conducted overseas in another currency, and unclear receipts will be flagged for manual review.

There’s no doubt that QuickBooks is a powerful platform for SMB accounting. The addition of Expensify to the business accounting digital landscape makes this process easier by allowing you to track, report, and migrate expenses, receipts, workflows, and other activities directly to your Quickbooks account. Gaining the ability to synchronize transactions in real-time from Expensify to Quickbooks ensures timely, accurate financial tracking and reporting without the need to dig through scraps of paper or perform other time-wasting, frustrating expense management necessities. Expensify is a bit of expense management software that supplements Quickbooks’ record-keeping and reporting capabilities. When these two technologies are fully synced, routine business activities like mileage tracking, reconciling credit card disbursements, workflow approvals, and more are transferred to the appropriate Quickbooks account or reported continuously as they are incurred. Expenses can be coded and filtered to your specifications for more precise financial management and transparency, and all of the data is added in real-time. It even handles expense reimbursements quickly so that your team isn’t left waiting. Once the accounts are set up and synchronized, approvals and disbursements are completed online.

How to Connect Expensify to QuickBooks

It’s easy to add the power of Expensify to your Quickbooks platform. For our purposes, we’re going to assume that you already have Quickbooks online. Once you install Expensify, it’s as easy as following a step-by-step process to trigger the automated integration between the two platforms.

- Setup and login to your Expensify account

- Choose your company profile from the settings tab

- Find the “connections” option and select Quickbooks from the drop-down menu, and this will trigger an automatic load of your Quickbooks account.

- log in to Quickbooks. Expensify will ask you to confirm that you would like to sync with Quickbooks. Choose yes.

- Save the connection to complete the process

Note that activities are recorded and managed as you specified during the setup process. For example, you’ll have to decide how you would like transactions like paying for airline tickets or tracking mileage should be labeled for export and which card or account that expense will originate from. After that, any transaction will automatically be recorded and exported to the corresponding designation in Quickbooks.

Even if you love crunching numbers, chances are you don’t have the time for IT or accounting chores. When you want to ensure that your Expensify to Quickbooks file transfers are fast and error-free, allow an accounting technology expert from Fusion CPA to oversee the process for you.

Ensure That Your Integration Flows Smoothly

______________________________________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.