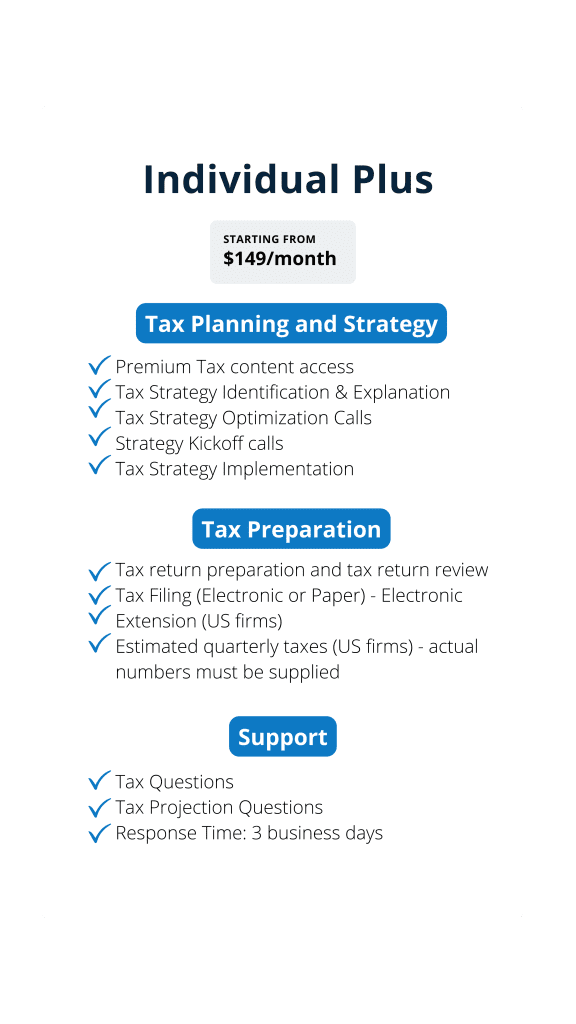

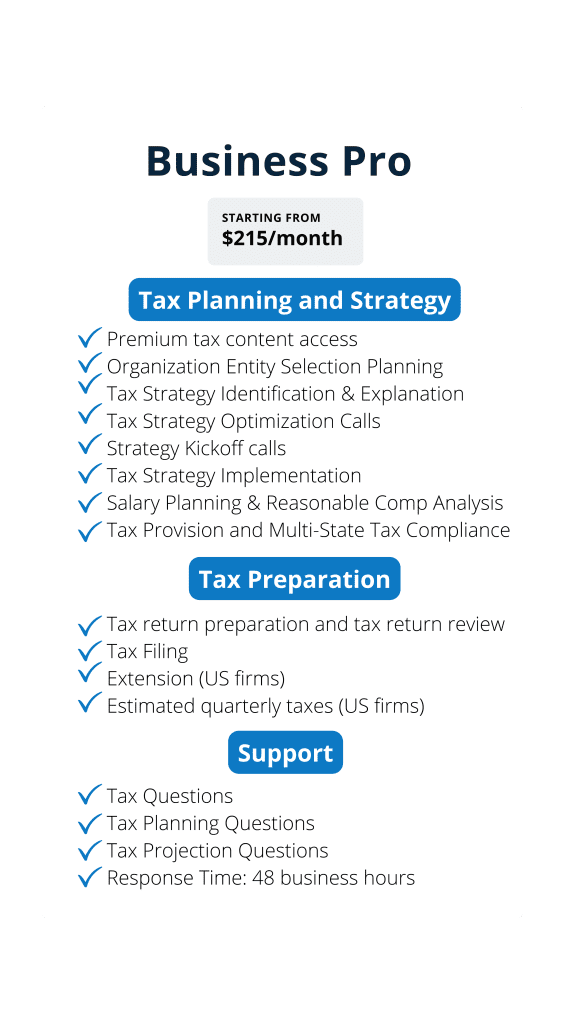

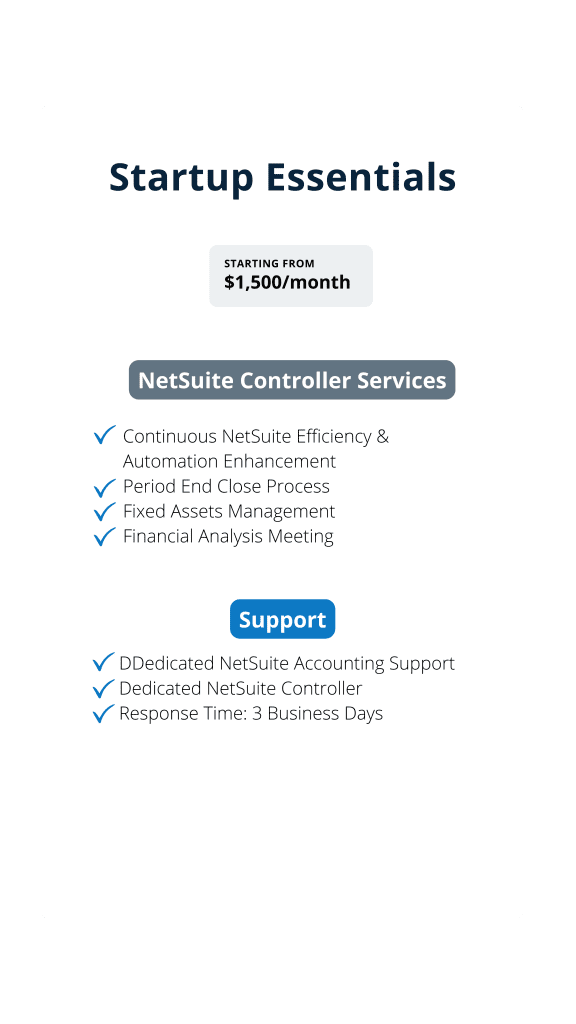

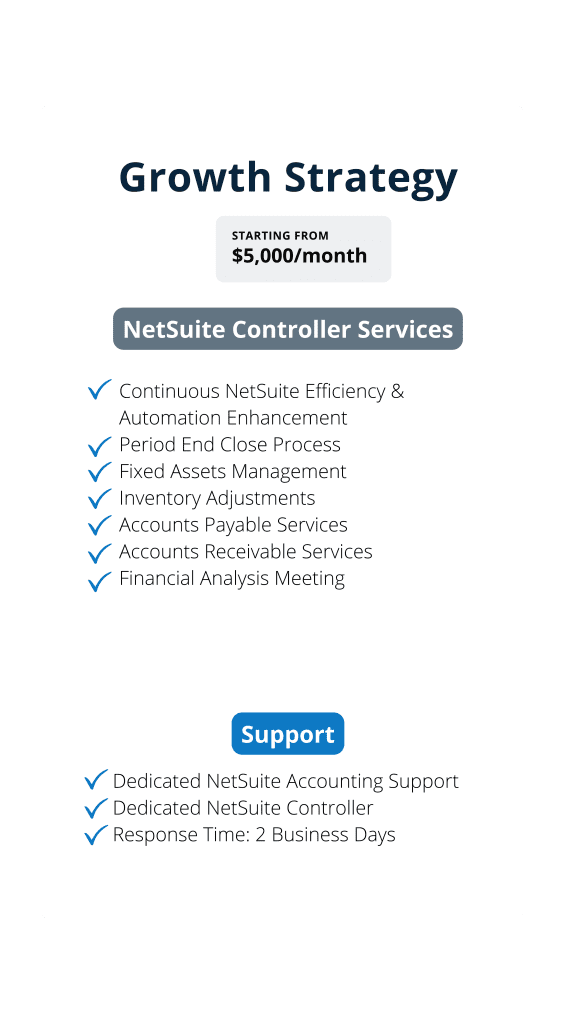

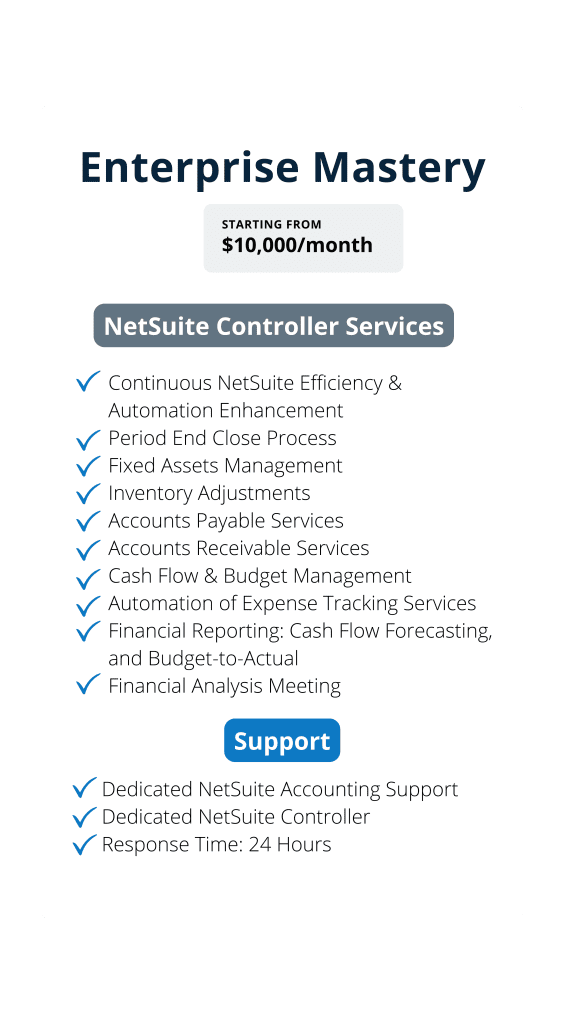

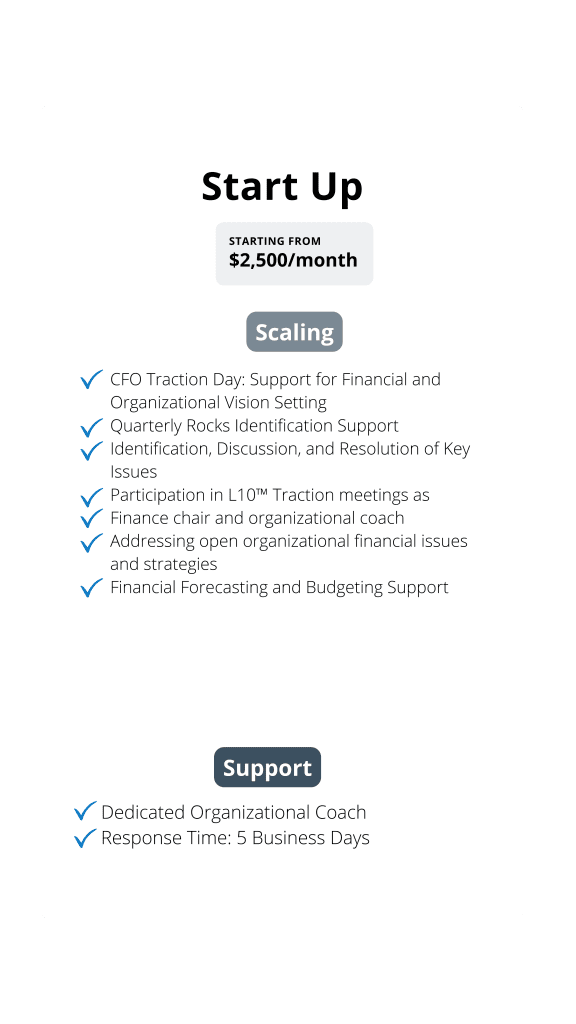

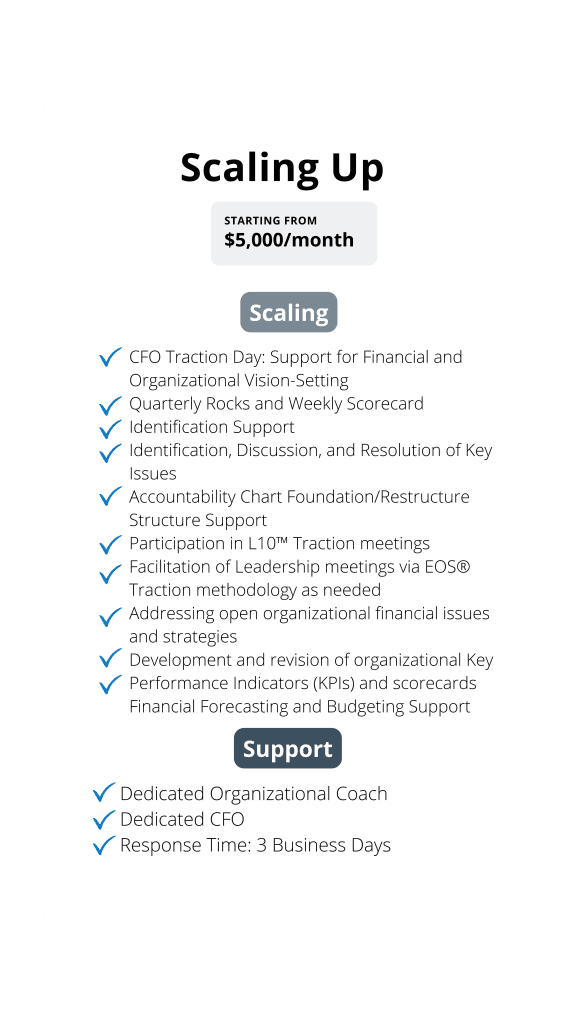

Tailored Pricing Plans to Match Your Business

Tailored Pricing Plans to Match Your Business

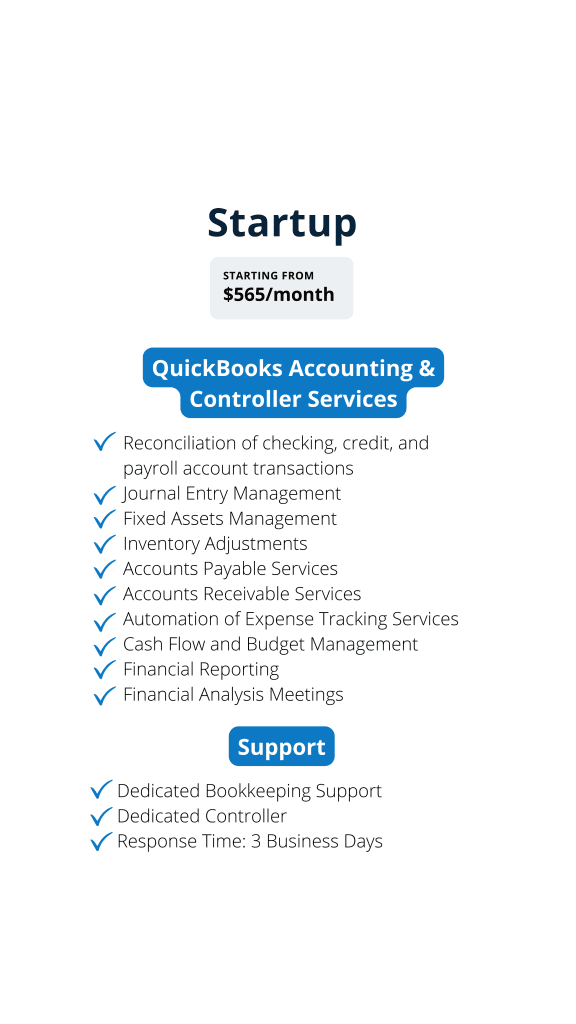

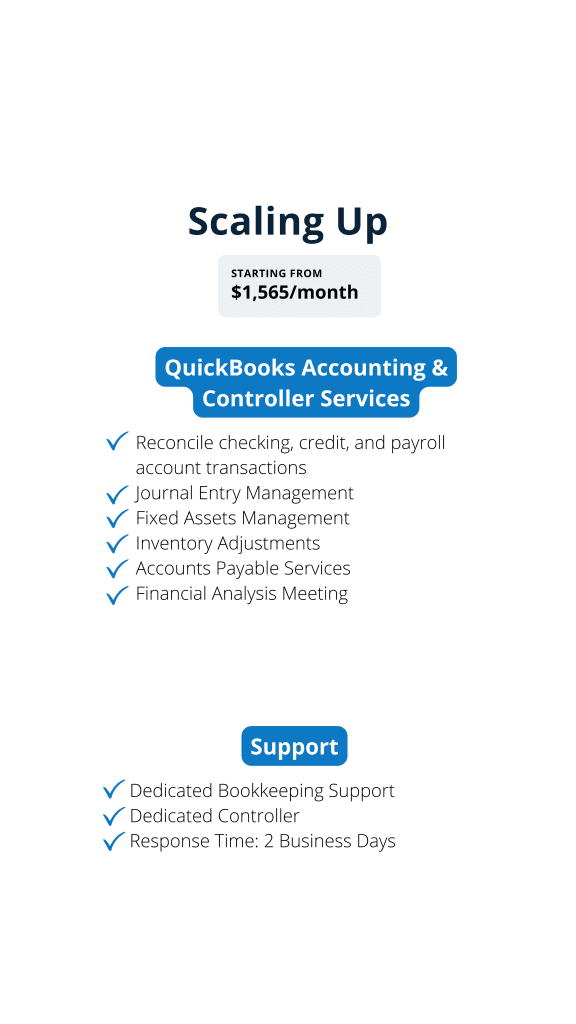

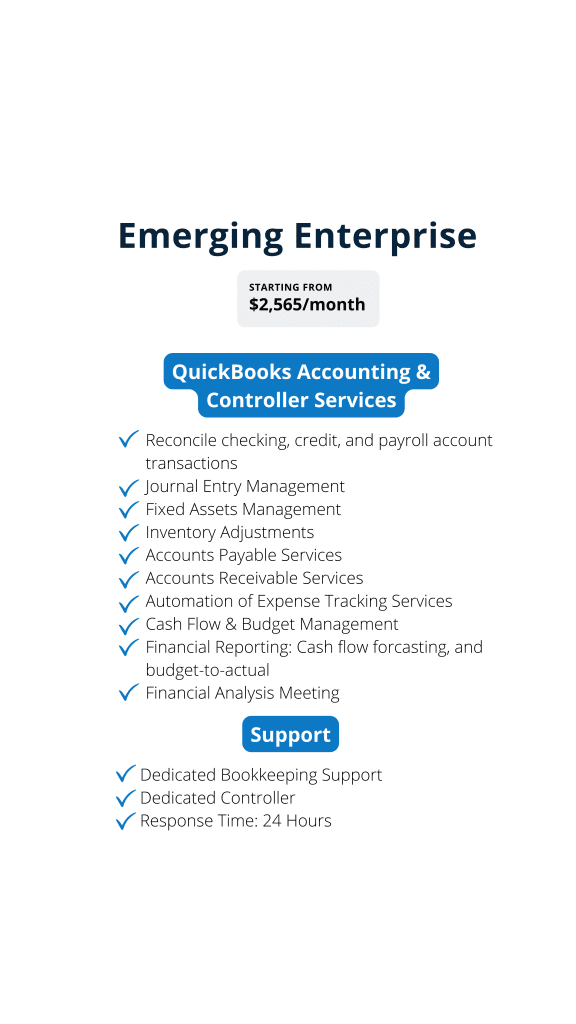

At Fusion CPA, we understand that businesses have diverse financial needs at different stages of growth.

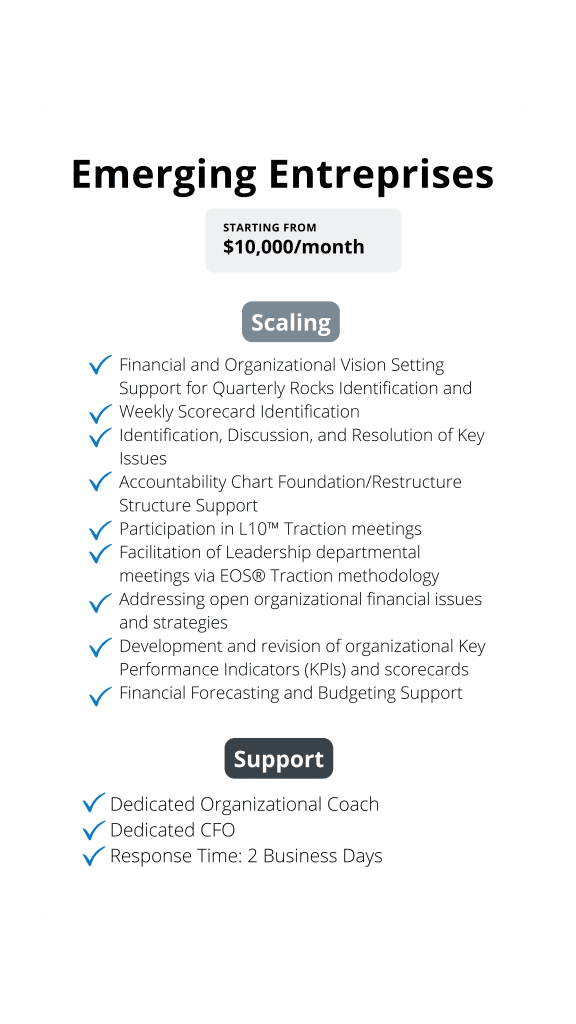

Our pricing models are designed to offer a solution for every stage, from startups to scaling enterprises – and fits your budget.

Get started with one of our experts today and focus on growing your business.