Private companies often find it difficult to attract and retain key employees. Part of the issue is large, multinational corporations offer more attractive compensation packages which often include various forms of equity compensation, including stock options.

You might also be a smaller company or a start-up that doesn’t have the cash flow yet to pay the market-rate salaries of top performers.

While equity in a private company can’t be traded on a public exchange, there are several methods private companies can implement to provide equity compensation to employees.

Before discussing the two most popular forms of equity compensation – restricted stock and stock options – here’s a summary of what your business can use equity compensation to accomplish, along with the different types of tax rates that apply to equity compensation.

Also read: What Makes Private Equity Fund Accounting Different

The Goals of Equity Compensation

Attract and retain high performers

As the worldwide economy continues to emerge from the COVID-19 pandemic, some industries are scrambling to find enough talent to fill open positions. There is an overabundance of open positions and not enough qualified applicants to fill those positions. One way to stand out from your competitors is by offering equity compensation.

If your company can demonstrate an upward financial trajectory, prospective employees could be incentivized to join your team with the prospect that their equity could be worth significantly more in the future. And even if your company doesn’t become the next Silicon Valley unicorn, modest growth could mean a decent future payday for your employees to whom you’ve granted equity compensation.

Get everyone working toward the same goal

The theory goes that providing equity compensation will give an employee an incentive to help grow the value of a company. If the company’s valuation increases, so will the value of an employee’s equity compensation. It also encourages employees to think long-term instead of short-term.

Free up cash

Equity compensation allows a company to pay less cash compensation now in return for paying (potentially!) higher cash compensation in the future. So instead of using cash to pay employees, companies can instead use cash for operating expenses or expansion opportunities. Deferring cash compensation payments is sometimes a necessary step for start-ups that may be strapped for cash during their early years.

Restricted Stock Compensation

The first type of equity compensation we’ll look at is restricted stock. As its name implies, restricted stock involves awarding or granting the right to own actual shares of a company’s stock.

There are two methods for compensating an employee using restricted stock: Restricted Stock Units and Restricted Stock Awards.

Restricted Stock Units (RSUs)

RSUs are a promise made to an employee by an employer to grant a given number of shares of the business’s stock to the employee. RSUs are generally granted based on a vesting schedule.

Let’s consider Jill, who becomes an employee of XYZ Company in June 2018 and is awarded 1,000 RSUs, which are put on a 5-year vesting schedule. Jill isn’t required to pay any money to acquire the RSUs.

On her one-year work anniversary, 200 of Jill’s RSUs vest. Jill exchanges the 200 RSUs for 200 actual shares of stock. On her two-year work anniversary, another 200 RSUs vest, which Jill exchanges for 200 actual shares of stock. Another 200 RSUs will vest in years 3, 4, and 5 and be exchanged for stock until all 1,000 RSUs are converted to 1,000 shares of stock.

How RSUs are taxed: Let’s assume XYZ Company’s stock is valued at $30 per share when Jill’s first 200 RSUs vest in June 2019. The total value of Jill’s 200 shares of stock is therefore $6,000 ($30 per share x 200 shares). This $6,000 is added to Jill’s Form W-2 as wages, which are subject to income, Social Security, and Medicare taxes.

Let’s see what Jill’s tax calculation looks during the 5-year vesting period, assuming that the price per share increases $5 each year:

- 2019: 200 shares @ $30 = $6,000 included in Jill’s Form W-2

- 2020: 200 shares @ $35 = $7,000 included in Jill’s Form W-2

- 2021: 200 shares @ $40 = $8,000 included in Jill’s Form W-2

- 2022: 200 shares @ $45 = $9,000 included in Jill’s Form W-2

- 2023: 200 shares @ $50 = $10,000 included in Jill’s Form W-2

Total vested shares: 1,000

The total income included in Jill’s Form W-2 over 5 years: $40,000

Sale of RSU Stock: Continuing our example, once the RSUs are converted to stock, Jill can either sell the stock right away or hold the stock and sell it at a later date. Here are Jill’s choices for selling her stock:

- Jill immediately sells her stock immediately after vesting – i.e. Jill receives stock for $30 a share and sells it for $30 a share. No gain or loss is recognized.

- Jill sells her stock within one year after vesting. Jill will report any gains as ordinary income and any loss as a short-term capital loss.

- Jill sells her stock more than one year after vesting. Jill will report any gains as a long-term capital gain and any loss as a long-term capital loss.

Restricted Stock Awards (RSAs)

A Restricted Stock Award (RSA) is a type of stock compensation plan where a company awards shares of the company’s stock to an employee, usually at the start of the person’s employment with the company.

The employee owns the stock – and is thus a shareholder – from the moment the company grants the stock to the employee. The employee, however, must wait until the shares have been vested before being able to sell the shares.

Let’s go back to Jill, assuming now that she becomes an employee of XYZ Company in June 2018 and is given a restricted stock award instead of restricted stock units:

- Jill is awarded 1,000 shares of stock for $0 per share in June 2018 when the stock’s value is $25 per share.

- The 1,000 shares are subject to a 5-year vesting period.

- The price per share increases by $5 each year.

- In 2023, after all, 1,000 shares vest, and the stock is valued at $50 per share.

- Jill continues to hold the shares until 2025 when she sells all 1,000 shares when the stock price is $60 per share.

How RSAs are taxed: The tax liability on RSAs is calculated using one of two methods:

At Vesting: The first method is exactly like RSUs. You wait for the shares to vest, then immediately pay ordinary income tax on the vested shares by including the income in Jill’s Form W-2. Using the information from our example:

- 2019: 200 shares @ $30 = $6,000 included in Jill’s Form W-2

- 2020: 200 shares @ $35 = $7,000 included in Jill’s Form W-2

- 2021: 200 shares @ $40 = $8,000 included in Jill’s Form W-2

- 2022: 200 shares @ $45 = $9,000 included in Jill’s Form W-2

- 2023: 200 shares @ $50 = $10,000 included in Jill’s Form W-2

Total vested shares: 1,000

The total income included in Jill’s Form W-2 over 5 years: $40,000

Calculating Jill’s tax liability based on the vesting schedule yields the same amount of additional income included in her Form W-2 over a 5-year period – $40,000 – as did the calculation for Restricted Stock Units.

83(b) Election: The second method Jill can use to calculate her tax liability is using an 83(b) election. Using this method, Jill pays ordinary income tax on all 1,000 shares immediately after receiving the stock award when she first joins the company, based on the share’s value at the date of grant:

2018: 1,000 shares @ $25 = $25,000 included in Jill’s Form W-2

Jill would earn $15,000 less ($40,000 – $25,000) using the 83(b) method to calculate her tax liability. If Jill’s tax rate was 20%, Jill would save $3,000 in taxes by using the 83(b) method.

Is an 83(b) election always a good idea? If you make an 83(b) election, you’re betting that your company is going to continue rising in value. You’re essentially pre-paying your tax liability on a low valuation.

But what happens if the opposite happens? You pre-pay your taxes at $25 a share, but then 5 years later the share price is $15? You could claim a capital loss based on the value of the shares, but the IRS won’t let you claim the overpaid taxes on your next tax return. You’re out of luck.

So, understand that an 83(b) election is an option to pre-pay your tax liability. If you think the value of your company will increase over the next 5 years, an 83(b) election should be something to consider.

Sale of RSA Stock: If the stock is held for one year or longer past the exercise date, long-term capital gains tax rates apply. Otherwise, any gain is considered ordinary income.

Stock Option Compensation

The second type of equity compensation we’ll examine is stock options.

A stock option gives an employee the right to purchase company stock during a specified period of time for a predetermined price.

Technical note: Stock options ARE NOT the same thing as stock.

Options are only the right to buy the stock at an agreed-upon price under a set of conditions. Also, the popular term “stock options” is technically not accurate. An employee only receives one “option” to purchase a pre-determined number of shares. So it’s not correct to say that an employee “has 500 stock options.” Rather, the employee has an option (one option) to purchase 500 shares at a certain price point in the future.

Here are the basic terms when discussing stock options:

- Grant Price – The specified price at which an employee can purchase a company’s stock (a.k.a. Exercise Price or Strike Price)

- Issue Date – The date the stock option is given to the employee

- Vesting Date – The date an employee can purchase the company’s stock for the grant price

- Exercise Date – The date an employee actually purchases the company’s stock for the grant price

- Expiration Date – The date by which an employee must exercise the options, otherwise the options will expire. (Options will typically expire 10 years after the grant date. If you leave the company, however, options will usually expire sooner than 10 years. For example, vested incentive stock options expire 90 days after leaving a company.)

Let’s look at the two different types of stock options – Non-Qualifying Stock Options and Incentive Stock Options – using Jill’s new employment with XYZ Company as our example.

Non-Qualifying Stock Options (NSOs)

Non-qualifying stock options permit an employee to buy a specific number of shares of a company’s stock at a specific price for a specified period of time.

NOTE: The name “non-qualifying” can confuse some people. “Non-qualifying” simply means that this type of stock option does not qualify for special treatment the same way incentive stock options are treated. You can also think about “non-qualifying” stock options as “regular” stock options.

Continuing with our example, Jill joins XYZ Company in June 2018 and is given a non-qualifying stock option for 1,000 shares at a grant/exercise/strike price of $5. Shares will vest at 25% per year:

- June 2018: Stock option granted

- June 2019: 250 shares vested

- June 2020: 250 shares vested

- June 2021: 250 shares vested

- June 2022: 250 shares vested

In June 2022, all 1,000 shares of XYZ Company’s stock have vested. Jill decides to exercise her option to buy all 1,000 shares at her grant price of $5 per share when the value of XYZ Company’s stock is $50 per share.

Jill writes her company a check for $5,000 (1,000 shares x $5 per share), and the company in return gives Jill 1,000 shares of stock. Jill is now officially a stockholder.

How NSOs are taxed: Jill paid $5 per share for a stock that is valued at $50 per share. This $45 difference is considered income to Jill and is included on her Form W-2:

1,000 shares x $45 difference between grant price ($5) and fair market value ($50) = $45,000 included on Jill’s Form W-2

Sale of NSO Stock: If the stock is held for one year or longer past the exercise date, long-term capital gains tax rates apply. Otherwise, any gain is considered ordinary income.

Incentive Stock Options (ISOs)

Incentive stock options are structured just like non-qualified stock options on the front end but receive preferential tax treatment if certain conditions are met when an employee exercises the stock options and ultimately sells the stock.

Let’s assume the same information from our non-qualifying stock options example with Jill, except this time Jill will receive an incentive stock option:

Jill joins XYZ Company in June 2018 and is given an incentive stock option for 1,000 shares at a grant/exercise/strike price of $5. Shares will vest at 25% per year:

- June 2018: Stock option granted

- June 2019: 250 shares vested

- June 2020: 250 shares vested

- June 2021: 250 shares vested

- June 2022: 250 shares vested

In June 2022, all 1,000 shares of XYZ Company’s stock have vested. Jill decides to exercise her option to buy all 1,000 shares at her grant price of $5 per share when the value of XYZ Company’s stock is $50 per share.

Jill writes her company a check for $5,000 (1,000 shares x $5 per share), and the company in return gives Jill 1,000 shares of stock. Jill is now officially a stockholder.

In our non-qualifying stock options example, Jill would have to pay taxes on the “bargain element” of the stock options she exercised ($45,000). With an incentive stock option, Jill would not have to pay taxes on the $45,000 IF she held on to the stock for at least a year after she exercised her options.

This is the most significant benefit of an incentive stock option: Jill will only pay long-term capital gain on the stock when she sells.

If Jill does not wait more than 1 year before selling her stock, she WILL pay ordinary income taxes on the $45,000 bargain element AND any gain.

Form 3921: Jill’s employer will complete Form 3921, “Exercise of an Incentive Stock Option”, and submit it to the IRS whenever Jill exercises her option to buy company stock.

In summary, ISOs can prove beneficial to employees because 1) Regular federal income tax is not triggered upon exercise of ISOs (although AMT might be), and 2) Qualifying dispositions of ISOs (selling your stock) enjoy long-term capital gains treatment.

In order to qualify for long-term capital gains, the option must be exercised during your employment and the shares issued upon exercise must be held for at least one year after the exercise date and at least two years from the date the option was originally granted.

ISOs can only be granted to employees (not to advisors, consultants, or other service providers).

Other considerations if you offer equity compensation

Understanding the tax consequences of various equity compensation packages is vital if you want to offer equity as a financial incentive for prospective employees. Offering equity compensation also presents several other challenges, as well:

- An added layer of complexity. Stock options and RSUs can be difficult to initially understand if you’ve never dealt with them before. If you want to offer equity compensation to employees, you’ll need a payroll processing system that can accurately track and calculate the options and RSUs associated with each employee. And don’t forget about explaining equity compensation to the employees themselves. They may be just as confused about stock options and RSUs as you may be, especially with the tax consequences of equity compensation.

- State nexus issues. You could grant an equity award to an employee in one location, but then the employee moves to another location before the equity award is exercised. Which taxing jurisdiction is entitled to the taxes from the equity compensation?

- Alternative minimum tax. The 2017 Tax Cuts and Jobs Act drastically reduced the number of Americans who get hit with the alternative minimum tax every year. But one group of taxpayers that are still in danger of getting hit with the alternative minimum tax are those who exercise stock options. If you have compensation tied to stock options or RSUs or have employees whose compensation is tied to stock options or RSUs, be sure to consult your tax advisor to find out the tax implications for your circumstances so you don’t end up with an unwanted tax surprise.

- Promotion schedule. Offering equity compensation most likely means that this employee is a high performer. High performers usually like to know the precise steps needed to grow in the company and earn promotions. If you want to keep your team around for the longest time possible, be sure to build a promotion ladder for your star employees.

So How Much Tax Will You Owe?

We’ve referred to several types of income in this article, including long-term capital gains and W-2 income. Here’s a look at the different types of income that can result from equity compensation, along with the different tax rates for the 2022 tax year:

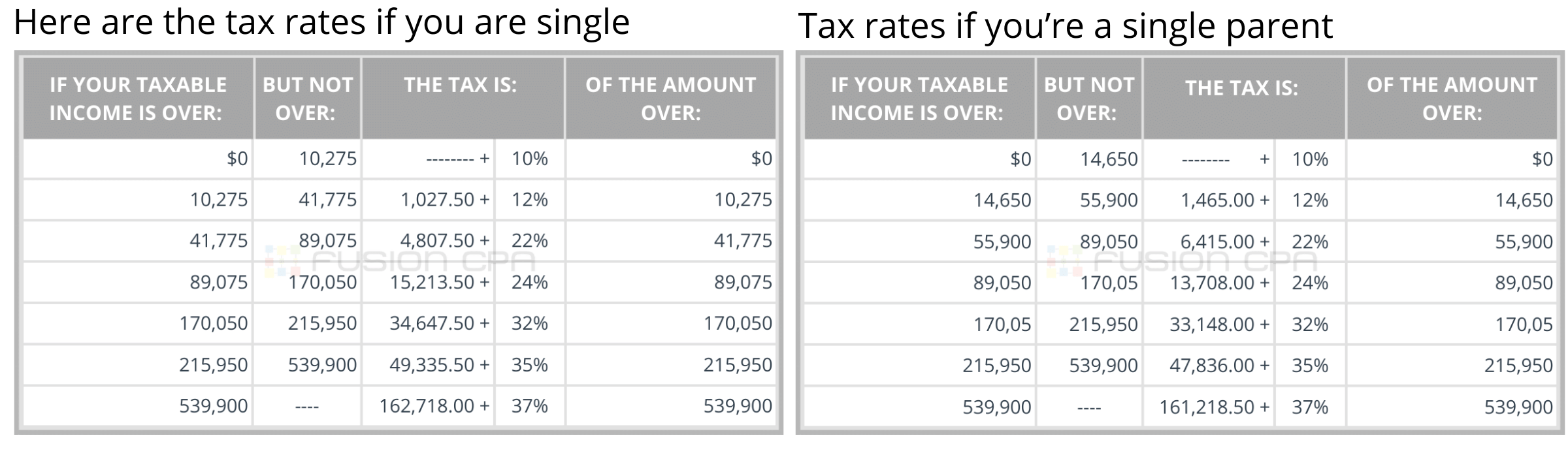

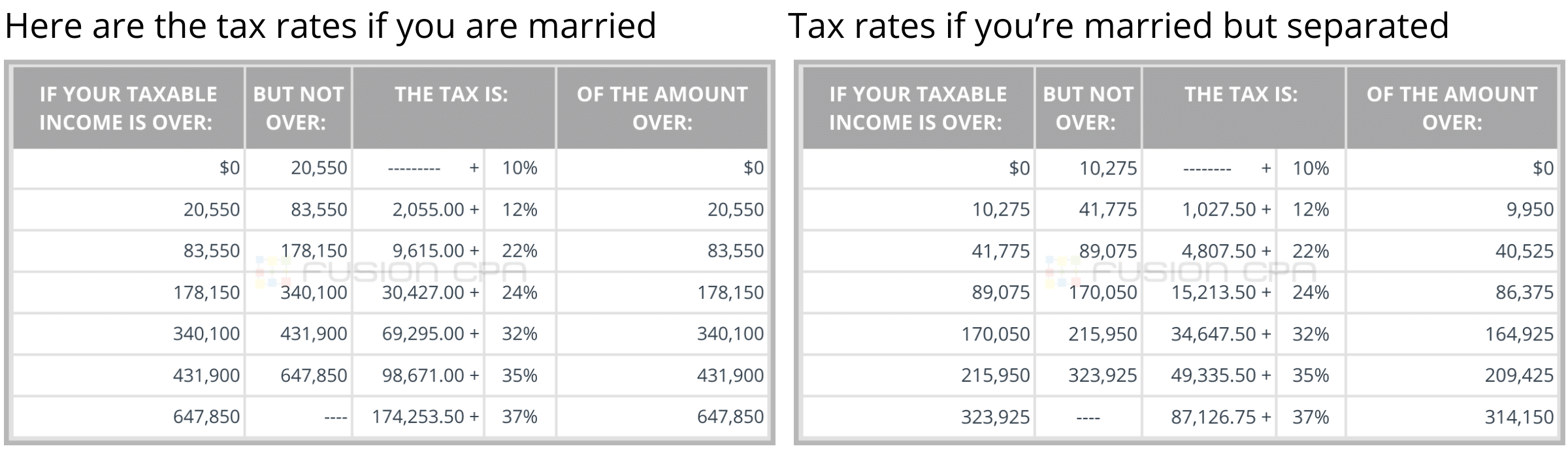

- Ordinary Income: This type of income includes wages, salaries, bonuses, and interest income earned on investments. For the 2022 tax year, the tax rate for ordinary income can be as high as 37%.

Here are the tax rates that will apply when filing your 2022 tax return by the April 2023 tax filing deadline:

- Ordinary Income (Part 2): In addition to paying income taxes on your ordinary income, you’ll also be paying Social Security and Medicare taxes on your ordinary income. As an employee, you’ll pay a 6.2% Social Security tax on the first $147,000 of your taxable income in 2022 (for a maximum tax of $9,114). You’ll also pay a 1.45% Medicare tax on all your ordinary income (there is no cap on the amount of income you’ll pay Medicare taxes on like Social Security). If you make more than $200,000 if you’re single, or $250,000 if you’re married, there’s an additional 0.9% Medicare surtax.

- Capital Gains Income: Capital gains income arises when you sell an asset, such as a stock. If you buy a stock for $15 and then sell it for $20, you pay taxes on the $5 increase in the value of the stock. If you sell the stock less than one year after purchasing the stock, you’ll have to pay a tax rate up to 37%. If you sell the stock more than one year after purchasing the stock, you’ll pay a tax rate no higher than 23.8% (a capital gain tax of 20% plus an investment surtax of 3.8%).

Equity Compensation Considerations For Your Business

Equity compensation isn’t just for Silicon Valley. It can be a valuable tool for attracting and retaining employees. Call us to discuss if adding equity compensation to your compensation package could be a competitive advantage for your business.

Equity Compensation Considerations As An Employee

If you have equity compensation as part of your compensation package, deciding the optimal time to exercise the option and when to sell can be potentially confusing. There are also multiple types of taxes that you’ll have to pay.

Fusion CPA offers outsourced financial services and accounting software solutions to business fund managers and PE firms. To determine the best scenario for your situation, call our office to schedule a comprehensive tax planning session.

This blog article is not intended to be the rendering of legal, accounting, tax advice, or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.