Whether to register an S corp, C corp or LLC entity is dependent on various factors and needs within your business.

Here we discuss the key features of each to help you gain an understanding of the entity status best suited to your business.

C corporations

The grandfather of business entities, the C corporation has come back in vogue the past 36 months thanks to the “Tax Cuts and Jobs Act of 2017,” which cut the tax rate for C corporations from 35% to 21%.

Famous (or rather infamous) for its double taxation of earnings, the C corporation is the preferred entity structure for venture capitalists and other institutional investors for two primary reasons:

- It’s easy to transfer ownership from an existing shareholder to a new or incoming shareholder, and

- The C corporation structure provides liability protection for the shareholders.

These significant benefits of easy ownership transfer and liability protection come at a cost, however: Double taxation and lots and lots of paperwork.

So what, exactly, do we mean when we say a C corporation’s earnings are taxed twice? The first layer of taxation happens at the entity level. The business itself pays a 21% tax on any net profit.

The second layer of taxation occurs when a shareholder wants to take money out of the business. While there are tax planning strategies to minimize this layer of taxation, in general, a shareholder must pay taxes on money taken from the business. The most common form of cash distribution from a C corporation to its shareholders is through a dividend. The maximum tax rate for dividends in 2019 is 20% (an additional 3.8% federal net investment income tax may also apply, bringing the total tax rate total to 23.8%).

To summarize, the primary drawbacks of organizing your business as a C corporation are double taxation, the high cost of filing the necessary paperwork to create the C corporation, and the ongoing legal and administrative work necessary to keep a C corporation in compliance with local, state, federal and international laws.

But for the right type of business, shareholder or investor, the benefits of organizing as a C corporation outweigh the aforementioned drawbacks.

S corporation

Not every business wants to attract institutional investors or eventually go public. Owners who want the liability protection of C corporations but an easier way to satisfy tax filing obligations can utilize the S corporation.

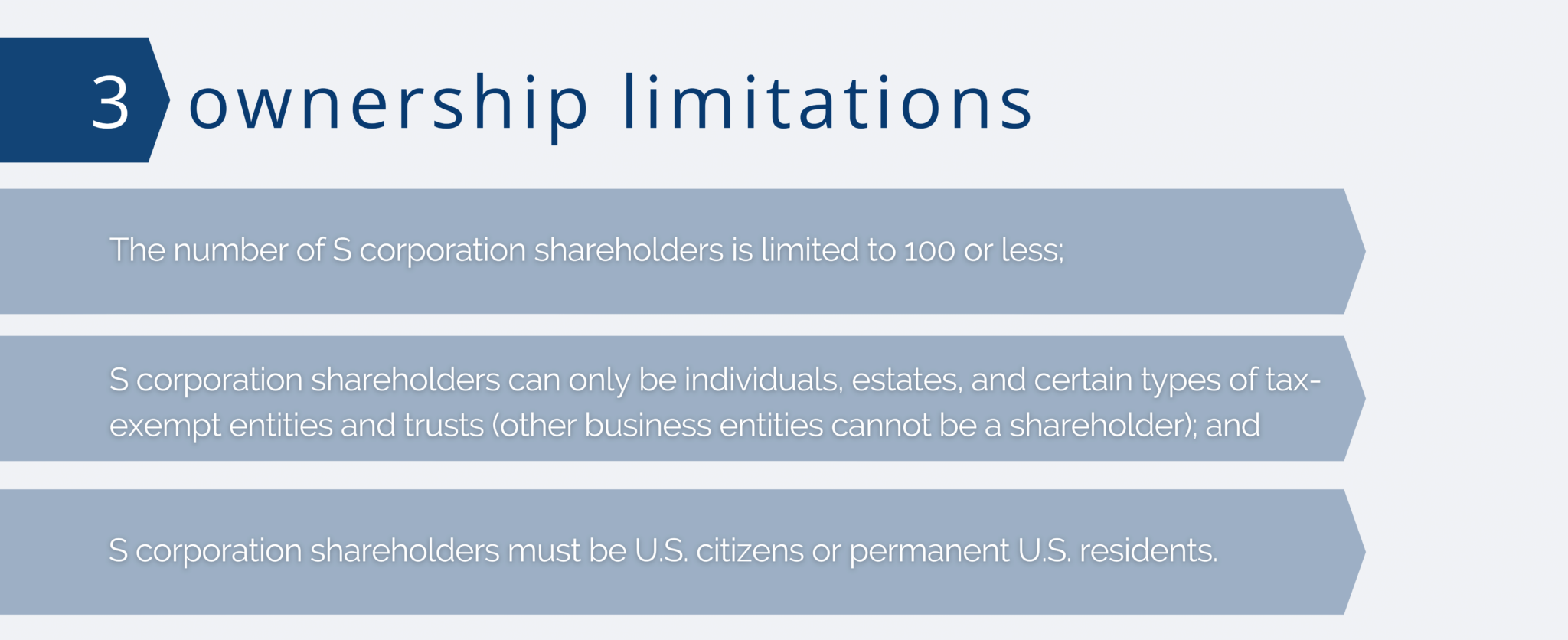

The reason why S corporations are not attractive to institutional investors are the three ownership limitations:

While these three ownership limitations cause institutional investors to shy away from S corporations, these ownership limitations are usually not an issue for the vast majority of business owners who are not institutional investors.

Many S corporation businesses, in fact, are “lifestyle” businesses that have only a handful of shareholders. These businesses will never have to worry about exceeding the 100 shareholder limit.

Another significant benefit of organizing a business as an S corporation is only dealing with one layer of taxation. While C corporation profits get taxed at the entity level, S corporation profits do not get taxed at the entity level. The profits from an S corporation flow from the business to the shareholder and get reported on the shareholder’s individual tax return.

Distributions from an S corporation to a shareholder are (generally) not taxable, while dividend distributions from a C corporation are subject to tax.

While there are limitations to who can be an S corporation shareholder, many businesses will never need to worry about these limitations. That’s why the S corporation entity is a very attractive option for smaller businesses with a limited number of owners.

Single Member Limited Liability Company

The most popular form of business entity today in the United States is the Limited Liability Company (LLC). An LLC with just one owner is referred to as either a “Single Member LLC” or a “disregarded entity” (since the IRS “disregards” the LLC entity for federal tax purposes.)

While LLCs and S corporations share many of the same characteristics, such as limited liability and pass-through taxation, there are several important differences that make the LLC a very popular choice of business entity.

First, LLCs do not have the shareholder limitations that S corporations face. States do not enforce any limitations on the number of members an LLC can have. (Owners of an LLC are called members, not partners.)

Second, S corporations must allocate profits and losses pro-rata. For example, an S corporation with two shareholders and an income of $100 for the most recent calendar year must divide the $100 equally, $50-$50, between the two shareholders.

LLCs (and all other forms of partnerships) can take that $100 of income and allocate $80 to one member and $20 to the other member, for example. This same type of special allocation can be done with expenses, as well. The flexibility to allocate economic transactions is a significant advantage of forming a business as an LLC. (There are guidelines for making special allocations that will be discussed in an upcoming article.)

The flexibility to make special allocations of income and expenses, however, comes with a downside – compliance requirements can become very significant, both in terms of time and money. Many attorneys and CPAs agree that the most complex component of the U.S. tax code is the section that governs partnerships (Subchapter K).

But don’t let these potential compliance requirements scare you from organizing as an LLC. Many smaller partnerships don’t consistently encounter these more complicated tax scenarios.

If your LLC does end up encountering these more complicated tax situations, chances are the business has grown to the point that the financial resources will be available to properly meet your compliance obligations.

Find out more about how these business entities are taxed:

Everything You Need to Know About Tax for SMLLCs

Everything You Need to Know About How Partnerships Are Taxed

__________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice, or other professional services. Articles are based on current or proposed tax rules at the time they are written, and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.