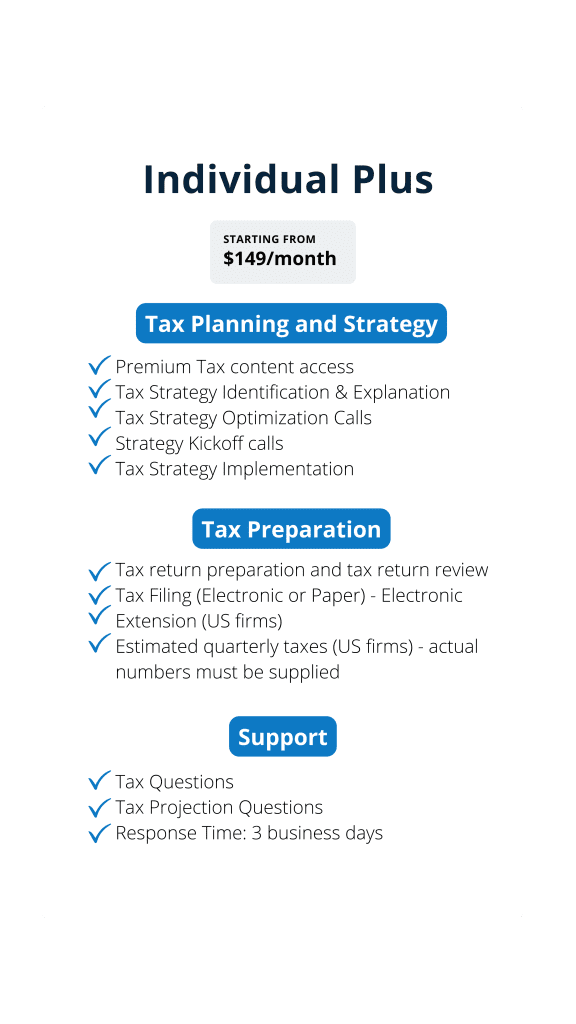

Individuals

It would take several pages to explain the basics of how tax is calculated in the United States because of the great diversity of taxpayers and their different financial situations. What you should know is that American taxation is progressive, which means that tax assessment levels will increase along with the income you report. Marginal and effective tax rates at the federal level have a lot to do with how tax is calculated; they range between 10% and 37% as of 2021, and they are by no means among the highest in the world.

If we were to boil down tax calculations to a single paragraph it would be as follows:

The most applicable filing status must be ascertained first; this is followed by a determination of all income sources and qualified deductions. These steps result in the calculation of taxable income, but there will be additional workflows to figure out if the overall tax liability can be lowered by means of credits such as education, healthcare, and child care in the case of individual tax returns.

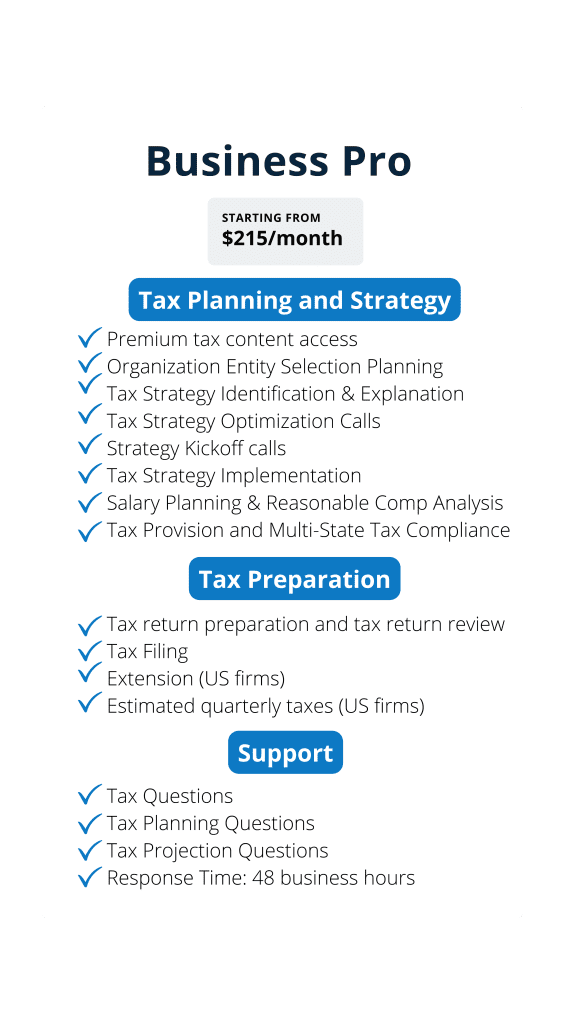

Businesses

Tax rates are currently 21% on taxable income for US C Corporations, whereas S Corporations and Partnerships remain “flow through” entities and are not subject to Federal tax.

The process is different for business entities because of matters related to equipment, depreciation, payroll, and quite a few others; nonetheless, the common denominator crucial to tax calculation will always be the determination of taxable income. You can read our article explaining US corporate tax rates.