Streamlining Food Industry Accounting With Acumatica Software

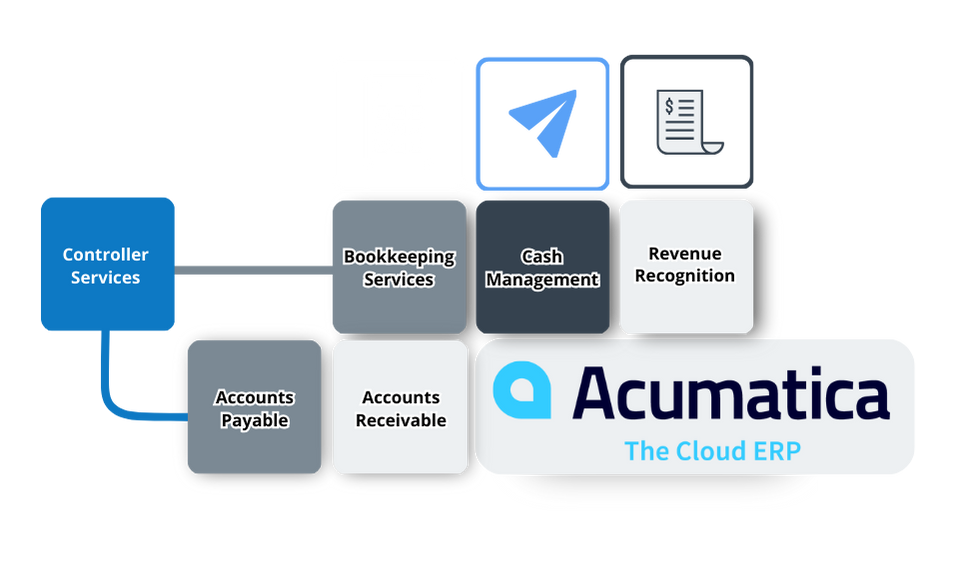

The food and beverage industry is competitive, with very thin margins. Businesses must keep track of where every penny goes. This is where accounting platforms like Acumatica come into play. It helps with food & beverage industry accounting to create a…