In addition to the universal accounting issues, which include managing income, payroll, and other business expenses; lawyers also need to accurately manage retainer funds and advanced trust fees. This can make accounting particularly challenging for lawyers.

Learn more about the accounting challenges to be aware of when running a law firm.

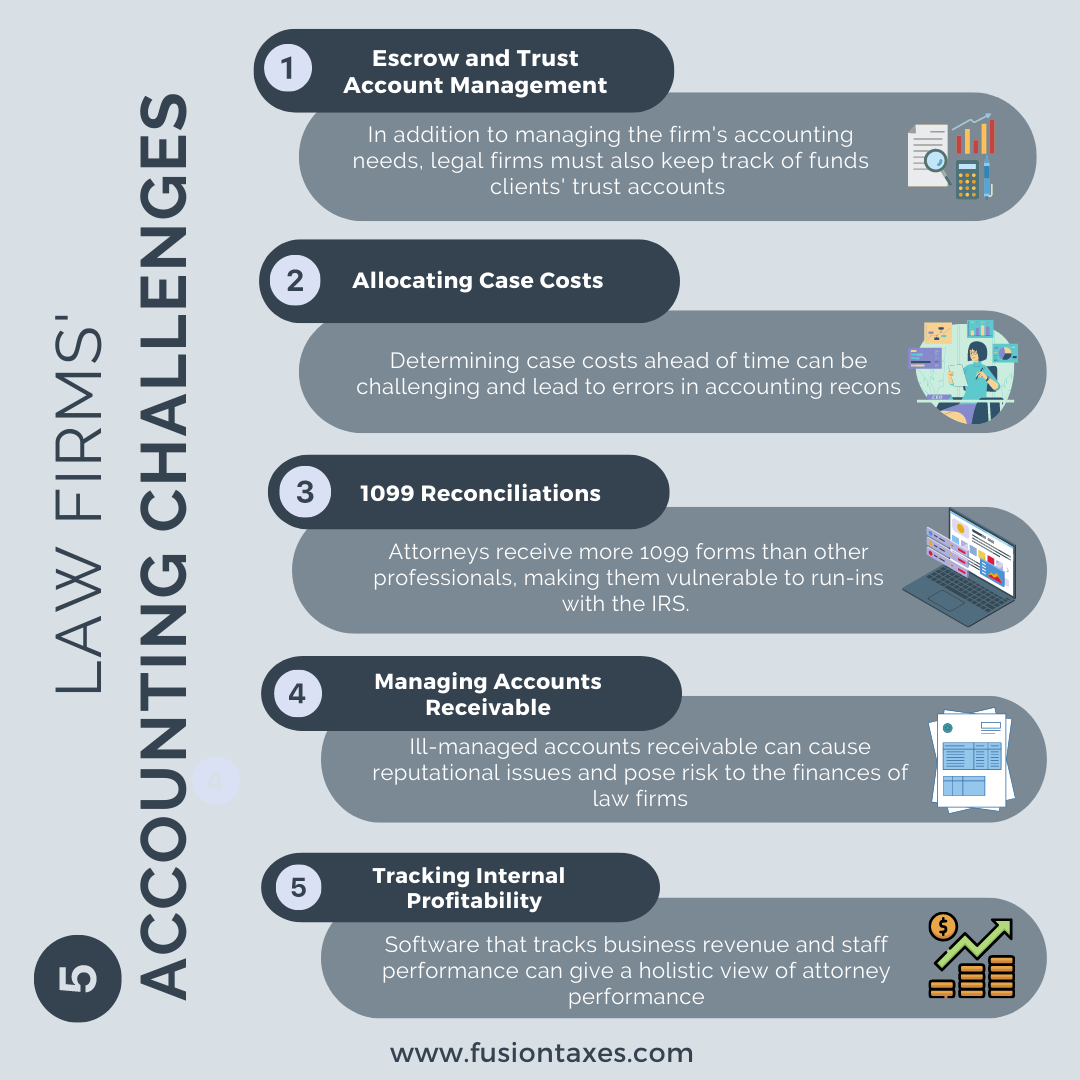

1. Escrow and Trust Account Management

Managing an escrow or trust account requires detailed bookkeeping for attorneys. This is a requirement that forms part of the property safekeeping rule which dictates holding assets on behalf of clients.

Accounting may become challenging for lawyers because along with their tracking of day-to-day transactions, law firms must also keep thorough records of funds deposited into the trust accounts of their clients. This not only carries great administrative demands, especially of an accounting nature; but it carries legal risk too. Whether you knowingly or unknowingly report and present inaccurate data and information, it can impact your credibility in the industry as well as affect your financial statements and tax obligations.

It is advisable for law firms to get proper accounting software set up, using reputable software like NetSuite or QuickBooks. This software is beneficial for managing escrow or trust accounts and ensures accurate tracking and reporting of escrow/trust transactions for multiple clients.

2. Allocating Case Costs

When planning a client’s legal case, lawyers must allocate associated costs for each client and for the legal project at large. Accurately determining these costs ahead of time may be a tall order and this is often where errors may happen. This is because lawyers cannot always know the direction a case will take, making it hard to predict the amount of added hours that might be logged on the project, and additional requests that clients might make. The challenge becomes greater when a client has paid their estimated deposit, and accurate records must be kept in this regard. Law firms can face various issues with cost allocation for case projects if they have no project management system to manage legal teams and costs. Implementing accounting software like Netsuite or Quickbooks will help improve efficiencies and aid in smoother tax filing.

3. 1099 Reconciliations

Attorneys receive and send more 1099 forms than other professionals, making them vulnerable to run-ins with the Internal Revenue Service. When companies retain an attorney and provide payments, the IRS tax code requires them to report the information using a 1099 form. If you fail to report the earnings on your income tax return, you may receive a notice from the federal agency about the missing income. Another complex issue is knowing whether you should be sending your clients 1099 forms for settlements. While it is unlikely and not standard practice for you to send a 1099 form to your client because you are not the payer, the clients you represent may not always do their due diligence to send you the form, which essentially is their responsibility, but since it is your income tax return, you might need to make use of a CPA to manage this process for you. 1099 forms can become complicated and laborious when servicing many different clients, the way lawyers do.

4. Managing Accounts Receivable

Another accounting pain point for law firms may relate to an ill-managed accounts receivable system. This can cause reputational issues due to potential disputes with your clients and has the potential to wreak havoc on the financial side of your business. The American Bar Association recommends that law firms provide an engagement or retainer letter for clients explaining the representation scope and rates. Every legal firm should have an accounting management system to process billing and collections, including tracking, invoicing, and sending monthly statements.

If you have a new private practice and work alone, start with QuickBooks Online and upgrade to NetSuite when your firm expands. Let an accounting expert set up the software, taking the bespoke needs of your industry into account.

5. Tracking Internal Attorney Profitability

Covid-19 caused law firms to reevaluate how to measure the performance, morale, retention, and other efforts expected from their lawyers. Revenue is a way to track internal attorney profitability but may not be painting the whole picture, especially when considering outstanding accounts, incorrect billing, and prolonged client cases. This can cause a law firm to question the efforts of its most diligent lawyers. Implementing an accounting setup that can track both revenue and staff performance, holistically, can help law firms get a more accurate view of the performance of their attorneys while tracking the financial position of the firm by taking into account all factors tied to an attorney’s portfolio.

Fusion CPA offers accounting and tax services to law firms and private lawyers. Our services include escrow and trust management. Our team of CPAs has experience in case cost allocation, 1099 reconciliation, settlements, accounts receivable, accounts payable, firm profitability, and more. Contact us to talk through your business needs.

View this article at a glance here:

_____________________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice, or other professional services. Articles are based on current or proposed tax rules at the time they are written, and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.