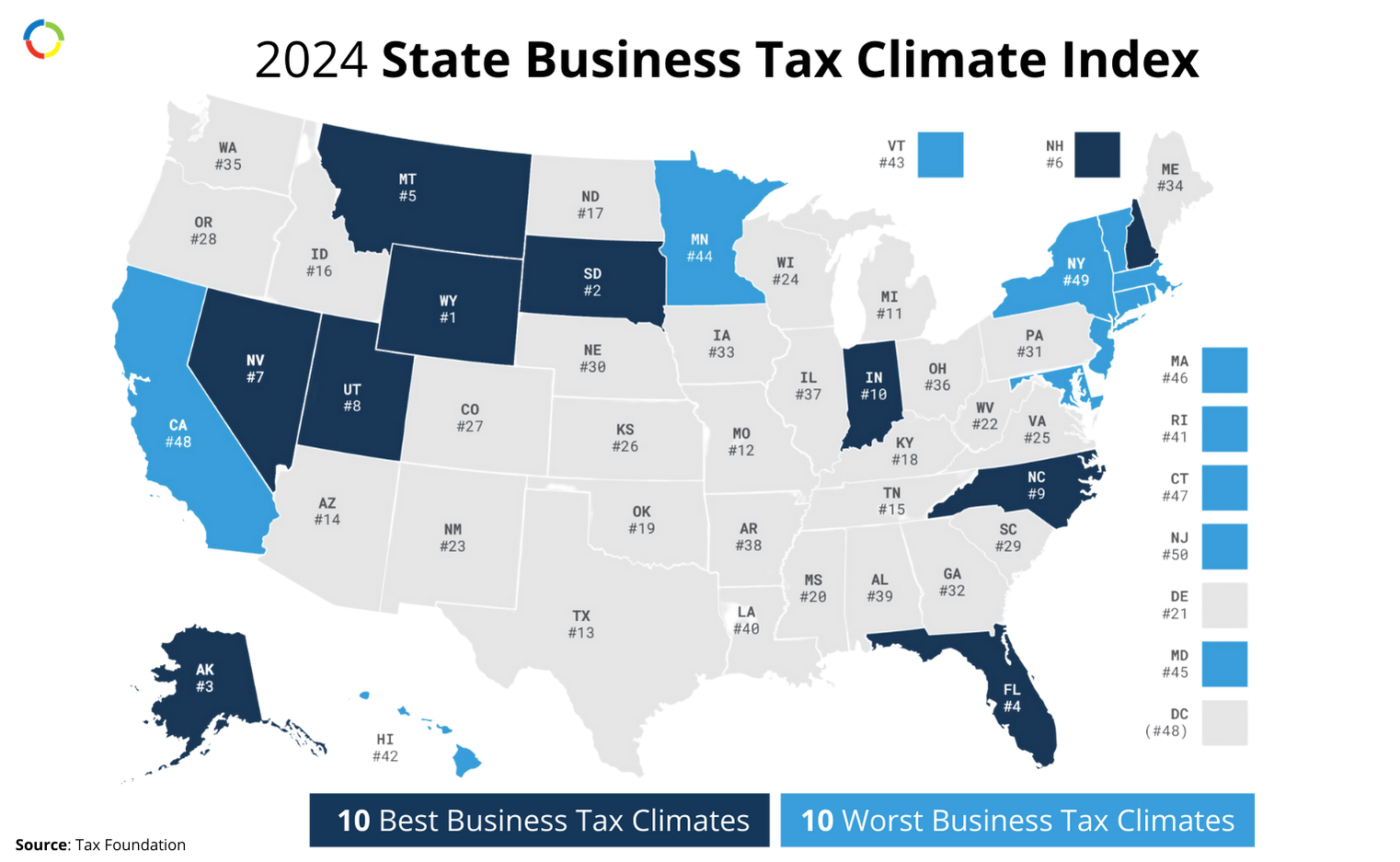

.Illinois offers a dynamic and diverse environment for businesses. However, it has one of the highest corporate tax rates in the country. The state has a 9.5% corporate income tax rate and a 4.95% individual income tax rate.

Understanding the cost of apportionment in the state can help you accurately report earnings to the IRS and local government.

Corporations

- Filing Requirements. S Corps must file Form IL-1120-ST, Small Business Corporation Replacement Tax Return. If you are a small business corporation, as defined in Internal Revenue Code (IRC), Section 1361(a), that has net income or loss as defined under the Illinois Income Tax Act (IITA); or is qualified to do business in the state of Illinois and is required to file U.S. Form 1120S (regardless of net income or loss).

If you own a qualified subchapter S subsidiary (QSSS) defined in IRC, Section 1361(b)(3), as well as any other entity that is disregarded as an entity separate from you for purposes of the IRC, it is likewise disregarded as a separate entity for purposes of the IITA. You must include all items of income, deduction, loss, credit, etc., from such entities on your return as if you earned or incurred them directly.

- Allocation & apportionment. Illinois follows the verified gross receipts rule in sourcing receipts from performance of services to the state.

Partnerships

Filing Requirements. You must file Form IL-1065, Partnership Replacement Tax Return, if you are a partnership, as defined in Internal Revenue Code (IRC), Section 761(a), that has base income or loss as defined under the Illinois Income Tax Act (IITA). A partnership that elected an IRC Section 761 exclusion from the federal partnership provisions is also excluded for purposes of the IITA.

Investment or Illinois Lottery. If you qualify as an investment partnership, you do not need to file Form IL-1065, even if you are required to file a federal tax return (federal Form 1065, U.S. Return of Partnership Income). See Illinois Income Tax Act (IITA) Section 1501(a)(11.5) for more information.

Employees & individual filers

Illinois residents must file Form IL-1040 if they file a federal income tax return. Additionally, if your Illinois base income from Line 9 is greater than your Illinois exemption allowance. If you are a nonresident and your only income in Illinois comes from one or more partnerships, S corporations, or trusts that withheld enough Illinois Income Tax to cover your liability, you do not need to file a Form IL-1040.

Ensuring Accurate Tax Filings

Consulting an expert CPA can help you keep a handle on different laws and tax implications.

At Fusion CPA we can help you take the stress out of tax season, so you can focus on what really matters.

_______________________________________________________

This blog article does not provide legal, accounting, tax advice, or other professional services. Our content is based on current or proposed tax rules at the time of publishing. Older don’t always reflect tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog. We also disclaim the same in relation to use or interpretation of this information. You should not rely on the information on this website as being all-inclusive.