For any business to succeed in the competitive business world today, having an organized and efficient accounting function is very important. One part of any company’s accounting and bookkeeping process is the accounts payable and bill pay system. When you can pay all of your bills on time, it can help you to stay on good terms with accountants and adequately manage your cash flow.

Understanding the Importance of Accounts Receivable and Accounts Payable Within Your Business

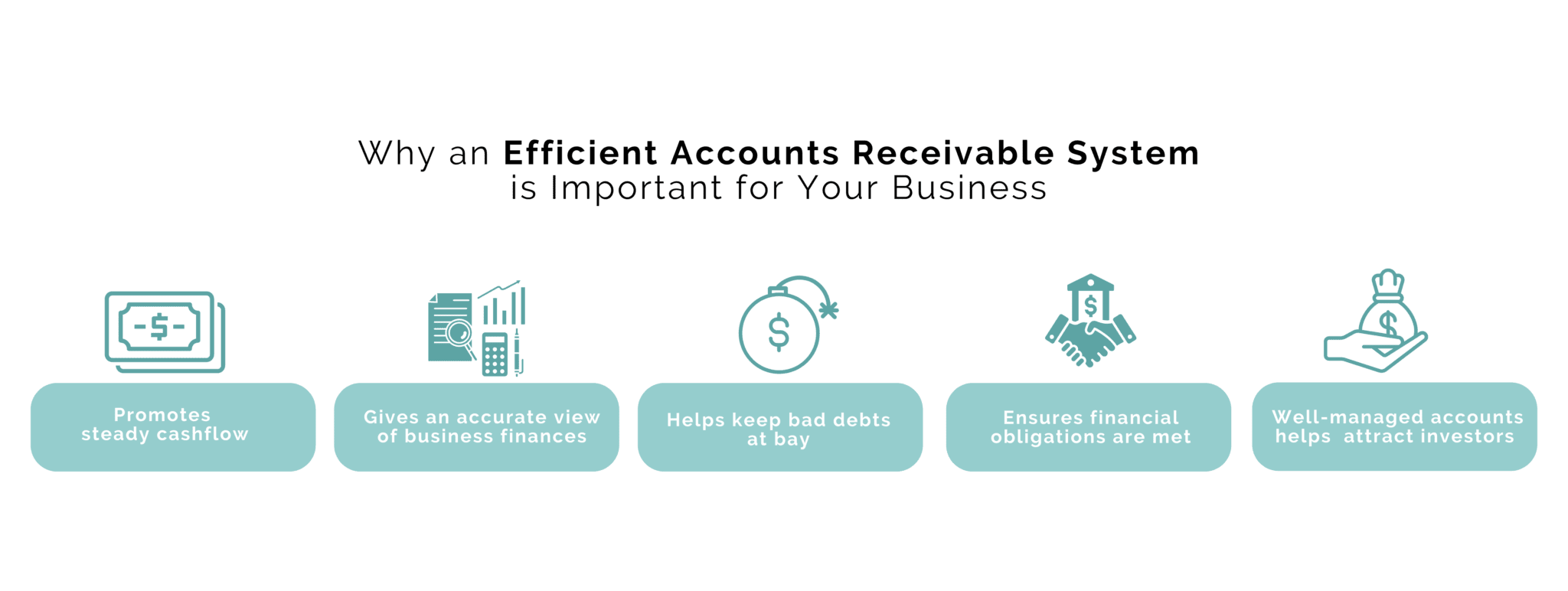

Steady cash flow is extremely important for the successful operation of any business. Accounts receivable is the payment your company gets from its customers to purchase goods or services on credit. Accounts payable refers to the money you owe suppliers for goods or services on trade credit.

Are you receiving money owed to you by clients on time, and do you pay your creditors on time? This is not only important for building meaningful business relationships, but also fundamental to the credibility of your business. Without credit purchases, it may be challenging to keep regular stock counts afloat. Similarly, if debtors aren’t paying you on time your business might run into cash flow issues. Tracking all your expenditures, payments, invoice statements, and purchase orders are very necessary to the financial well-being and operations of your business.

To help improve this function within your business, using a bill pay software program could be very helpful. These programs can help to keep a company more organized and efficient. Overall, several benefits, in particular, come when you use a professional software program for your accounts payable and management.

Streamlined and Accurate Processing

One of the benefits of using accounts payable software is that it can streamline and organize your Accounts Payable functionality. Any business that uses various vendors and service providers can quickly become overwhelmed with the number of bills that need to be paid out each month. This can make it easy to fall behind on the bills that you owe. With accounts payable and bill pay software, it will be much easier to automatically organize your bills and process them. This will ensure that your vendors get paid on time.

An additional benefit of the accounts payable system is that it can save you money. A company that does not use an automated bill pay system will undoubtedly spend a lot more. Without an automated system, you will need to hire a range of different people only to manage this functionality. When you use a bill pay program, you can reduce the necessary human capital. This will allow you to allocate these valuable resources to other areas of your business.

Integration with Tax Systems

At the end of the year, businesses may need to file taxes at the state and federal levels. This can be a significant challenge as organizing all of the necessary records can take time. When you have an accounts payable program, it will help with tax planning as it can link directly to your tax reporting programs. This will ensure that all of your expenses are appropriately accounted for, which can ensure accuracy and even reduce your tax liability when tax planning.

Assistance With Production of Financial Records

Any business is going to need to be able to provide financial records regularly. This can include producing a balance sheet, past income statements, cash flow statements, and payable and receivable reports. These may need to be provided to a financial advisor, bank, investor, or other interested parties. When you have an accounts payable system integrated with your bookkeeping system, it may help ensure that you can produce accurate financial records regularly.

Cash Flow Management

Even if your business today is hugely successful, managing cash flow is always a challenge. Through the use of a financial advisor and the right software programs, you can get a sense of your actual cash flow position. The accounts payable and bill pay program is an essential part of this system and process. When you have these adequately linked, you will be able to review your cash position and upcoming payables. This will allow you to forecast which payable needs to be paid and when which should ensure you can identify if there is going to be a cash shortage at any given time.

If it’s time to get some assistance with your finances, let us help. We have a team of Outsourced Controllers, CPAs, and Tax Experts that are with you every step of the way.

Each business faces certain critical financial challenges that we can help address. We pave the way for sustainable growth with our three-step process. And without the commitment of an in-house accountant, tax, or finance team! Contact us today!

_________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice, or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.