Every industry has its challenges, and marketing is no different – especially when it comes to dealing with accounting methods, refunds for ad campaigns, cost and profitability calculations, and other accounting-related complexities. Learn more about common accounting pain points that marketing businesses need to be aware of.

1. Cash vs Accrual Accounting

Accounting methods and how they impact cash flow within a business are not always easy for non-accounting professionals to understand. Similarly so, marketing professionals may not always know whether to use the cash or accrual accounting method when recording transactions. While most small businesses use the cash-based method because it is much simpler, in that it records a transaction when the business receives the cash, there may be challenges when using this method when filing your taxes. If you run a marketing business, the cash basis may be preferable, but if your agency receives significant deposits and retainers, the IRS may require your business to make use of the accrual method. If your agency makes over $25 million in sales for three consecutive years, the IRS will require you to use the accrual accounting method. If your marketing firm follows the cash-based accounting method but falls into the IRS category for having to make use of the accrual accounting method, then your business may be faced with an accounting challenge that would require consultation with a CPA that understands how to file your taxes.

2. Misallocating Client Reimbursements

Among accounting pain points that marketing agencies may experience, refund allocation for advertisement campaign services is probably the most common. This is because allocating the reimbursement and the timing of the reversal of the funds by the bank, may be vastly different. Some credit card companies take three to seven business days before refunding the client’s account. This may create a disparity between your books and the bank recon statement. Consulting a CPA on the best way in which to manage this from a bookkeeping perspective is imperative to a smoother tax filing process.

3. Not Tracking Employee Time and Profitability

Research suggests that personnel is the driving force behind increasing revenue, customer experience, and profitability, which all play an integral role in company success. It’s not only about losing money in salaries when it comes to marketing representatives that aren’t accurately tracked for hours, it is also about ensuring quality service delivery. Without good workers, your agency’s reputation is at stake. Setting up accounting software, such as QuickBooks Online or NetSuite, helps to overcome accounting challenges by aiding employee time tracking and managing profitability.

4. Contractor vs Employee Reporting

Knowing when to treat a worker as an employee or contractor, is another challenge that many industries face. This especially difficult in the marketing industry, where it is possible to outsource a lot of the ad-hoc campaign outputs to contractors. Not only does it free your full-time staff to focus on maintaining relationships and taking care of the core business, it also minimizes employee tax run-ins with the IRS, and encourages smoother business tax reporting.

One substantial difference between a contractor and an employee is reporting their earnings on the appropriate IRS tax forms for marketing businesses. Failure to withhold social security, medicare, and federal withholding from employee paychecks and pay employment taxes can result in costly consequences. These are some of the things to consider when hiring employees and setting up the accounting infrastructure for your marketing agency.

5. Project Costs and Profitability Accounting

Project cost and profitability are complex accounting processes that can be challenging for marketing managers in charge of financial management and budget allocation. Often, mistakes happen because the quoted pricing of a project is inaccurate. This can affect the expected profit projection during a marketing project’s lifecycle. Minimizing or eliminating accounting challenges for marketing businesses begins with a strategic plan for time and output costing. This can be done by analyzing the financial data and capacity of your business in conjunction with a financial expert that understands costing, profitability, and the costs of keeping your business running with the goal of expansion.

At Fusion, our CPAs are trained to set up accounting software to best serve the needs of your marketing agency and to help you keep your books clean for a smoother tax filing process. Contact us to discuss the best accounting approach for your marketing firm.

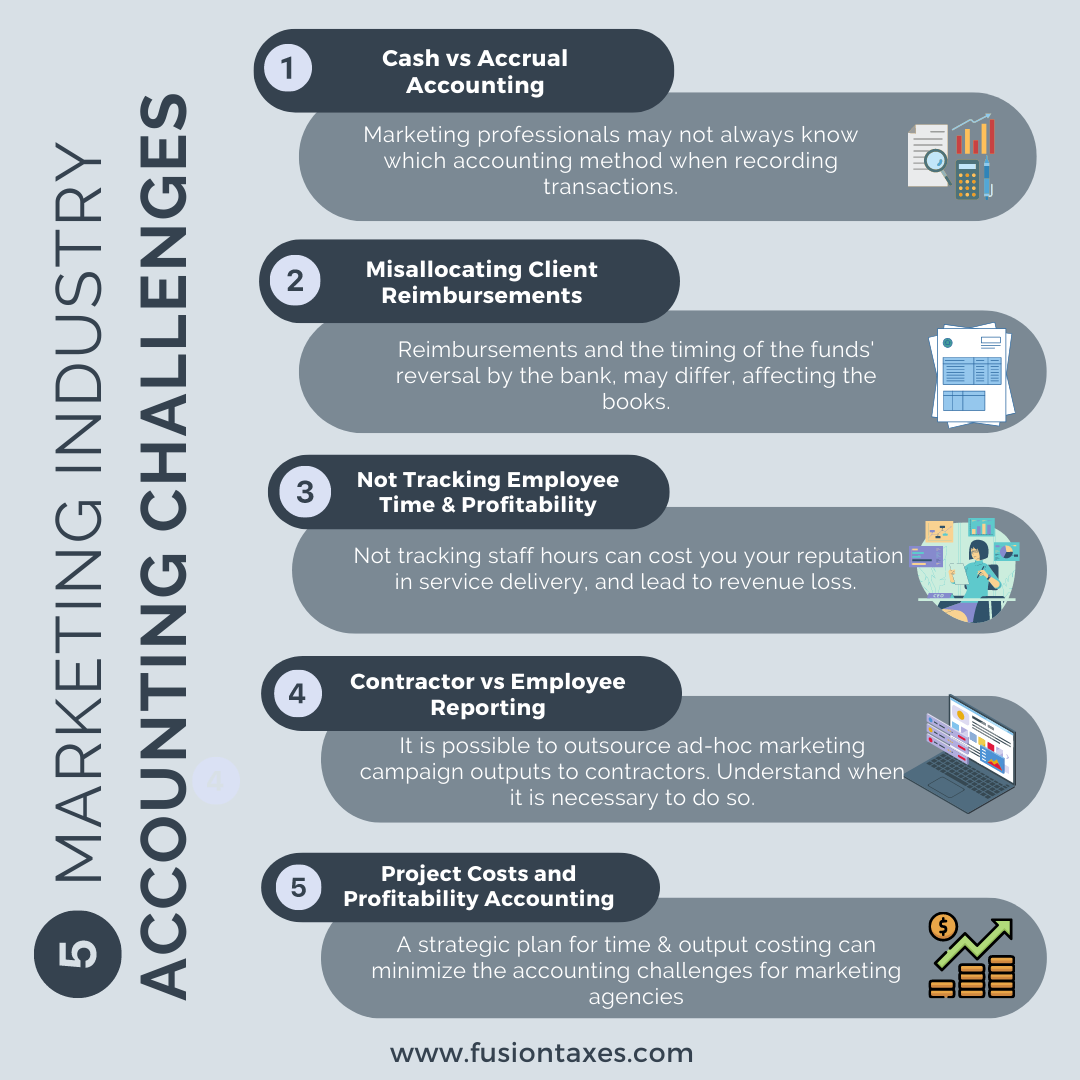

View this article at a glance, here:

______________________________________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.