Outsourcing Your Atlanta Bookkeeping For Business Success

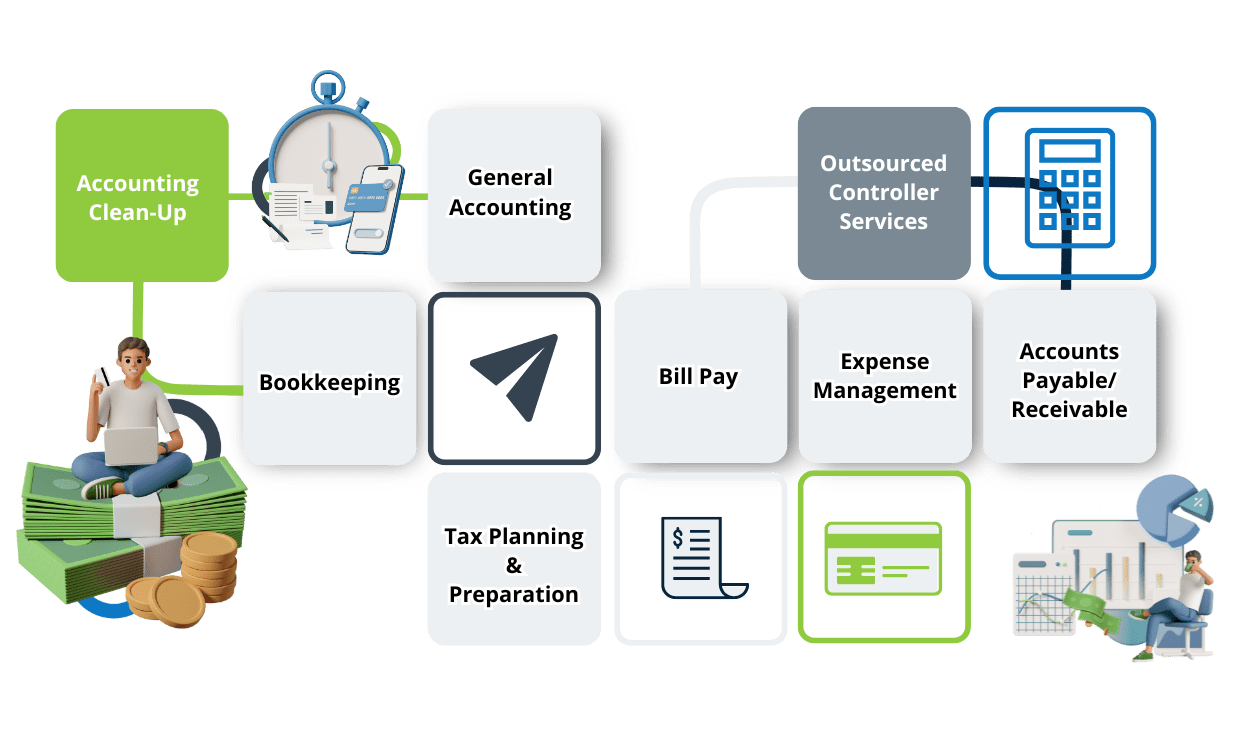

Accounting is one of those business processes that are non-negotiable. Bookkeeping is a core business process that often requires constant dedication, and this factor alone makes it ideal for outsourcing.