Sage Intacct Accountants

Let's talk about how Sage Intacct can make your organization’s bookkeeping simpler and more efficient simultaneously.

Sage Intacct Accountants

Let’s talk about how Sage Intacct can make your organization’s bookkeeping at your simpler and more efficient simultaneously.

Sage Intacct accounting software streamlines and upgrades workflows via a dynamic user interface. It’s a favored bookkeeping platform across all industries due to its integrations with popular cloud services like ADP and Salesforce.

Our team of experienced Sage Intacct accountants can scale the features of this comprehensive cloud accounting platform to businesses of all sizes. Many businesses are converting to the platform to streamline accounting and tax planning using a multilayered, unified interface. Sage Intacct’s automated workflows and reports make it possible to replace multiple programs with one platform.

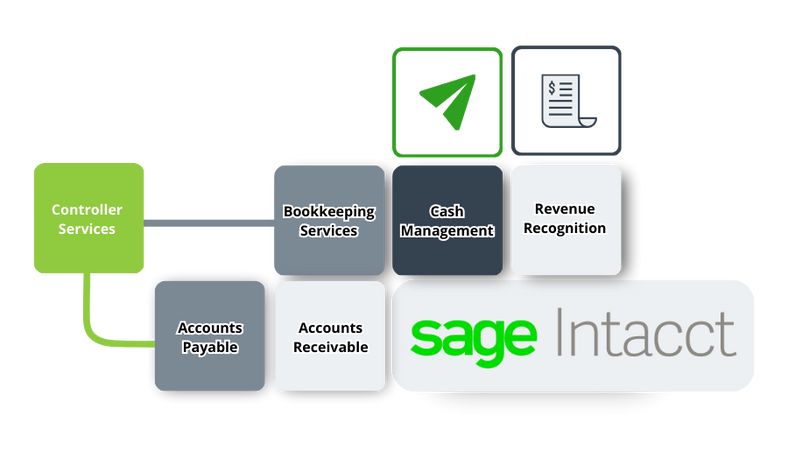

Here's a look at what's covered for core financials and billing:

Accounts payable

Accounts receivable

Cash management

Order management

Purchasing

Contract and subscription billing

Project costing and billing

Revenue recognition

Elevate your platform with tailored solutions for automated currency conversions, seamless inter-entity transactions, and streamlined local tax reporting. Sage Intacct empowers you to create dynamic dashboards and real-time reports, providing unparalleled visibility into your business operations.

“My company has been working with Fusion for about a year now and they have really helped simplify things on our end. Having your accounting and bookkeeping done under one roof really takes the stress out of coordinating between the two on a regular basis. Their team is very personable and prompt. Every question I have had, they are there to answer (even the annoying ones I’m sure). I would definitely recommend these guys!”

Alexandria M

Utilizing a professional CPA’s medical accounting knowledge and experience can help ensure your business has your accounting needs met correctly and successfully.

Access to dedicated healthcare CPAs, who understand the medical industry’s ins and outs, can help create a highly tailored answer to your accounting requirements.

Book a Discovery Call at your convenience for any questions about our Sage Intacct implementation and accounting services.

We pave the way for sustainable growth with our 3 step process

Join our client journey without the commitment of an in-house accountant, tax or finance team!

Minimize Accounting Errors

Work with accountants who understand the intricacies of your industry. If you are ready to take control of your finances and accounting while maintaining your peace of mind, contact Fusion CPA to learn more about the services we provide.